Discover The Best Tax Software Reviews 2023: Maximize Your Returns!

Tax Software Reviews 2023

Introduction

Good day, Readers! Today, we will delve into the world of tax software and provide you with comprehensive reviews for the year 2023. As tax season approaches, having the right software to streamline your tax preparation process can be a game-changer. In this article, we will explore the various features, advantages, and disadvantages of different tax software options available in the market, ensuring you make an informed decision. So, let’s dive in and discover the best tax software for your needs!

1 Picture Gallery: Discover The Best Tax Software Reviews 2023: Maximize Your Returns!

Table of Contents

What is Tax Software? 📚

Who Can Benefit from Tax Software? 🤔

When Should You Start Using Tax Software? 📅

Where to Find Reliable Tax Software? 🌍

Why Use Tax Software? 🤷♀️

How to Choose the Right Tax Software? 🧐

Advantages and Disadvantages of Tax Software 📈📉

FAQs ❓

Conclusion 🎯

Final Remarks 📝

What is Tax Software? 📚

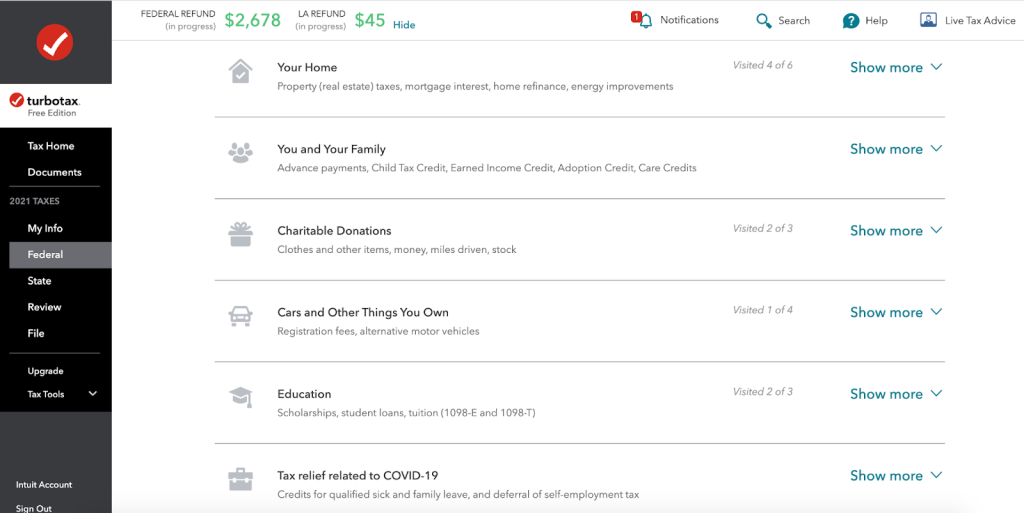

Image Source: forbes.com

Tax software refers to a computer-based program designed to assist individuals and businesses in preparing and filing their tax returns. These software applications automate the process, making it easier, faster, and more accurate than traditional manual methods. With tax software, users can input their financial information, deductions, and credits, and the software will calculate their tax liability or refund. Additionally, tax software often comes with features such as error-checking, electronic filing options, and access to up-to-date tax laws and regulations.

Understanding the Benefits of Tax Software

Tax software offers numerous benefits to users. Firstly, it simplifies the tax filing process by providing a user-friendly interface and step-by-step guidance. This eliminates the need to decipher complex tax forms and instructions manually. Secondly, tax software minimizes errors by performing calculations automatically and flagging potential mistakes or missing information. Furthermore, it enables users to maximize their deductions and credits by prompting them to provide relevant information and offering suggestions based on their circumstances. Lastly, tax software saves time and effort as it eliminates the need for manual calculations, reduces paperwork, and allows for electronic filing.

Who Can Benefit from Tax Software? 🤔

Tax software is beneficial for individuals, self-employed individuals, small businesses, and even larger corporations. Whether you have a simple tax return or complex financial situations, tax software can cater to your needs. Individuals with multiple sources of income, rental properties, investments, or business expenses can particularly benefit from tax software. Additionally, tax professionals and accountants can also utilize tax software to efficiently manage and prepare tax returns for their clients.

When Should You Start Using Tax Software? 📅

It is recommended to start using tax software as early as possible in the tax year. By doing so, you can begin organizing your financial records and inputting data into the software. This allows you to stay on top of your tax obligations and avoid any last-minute rush or mistakes. By starting early, you also have more time to explore different tax software options, compare features, and select the one that best suits your needs.

Where to Find Reliable Tax Software? 🌍

There are numerous tax software options available in the market, both online and offline. Some of the most reputable tax software providers include TurboTax, H&R Block, TaxAct, and TaxSlayer. These companies offer a range of products tailored for different user requirements and budgets. It is advisable to visit their official websites, read customer reviews, and compare features to determine which tax software aligns with your specific needs.

Why Use Tax Software? 🤷♀️

Using tax software provides several advantages. Firstly, it ensures accuracy by performing complex calculations automatically, minimizing the risk of human error. Additionally, tax software keeps you up to date with the latest tax laws and regulations, ensuring compliance and avoiding penalties. Moreover, tax software saves you time and effort by automating repetitive tasks and guiding you through the filing process. Lastly, tax software offers convenience with features like electronic filing, direct deposit options, and access to prior-year tax returns.

How to Choose the Right Tax Software? 🧐

When selecting tax software, there are several factors to consider. Firstly, determine the complexity of your tax situation and choose software that suits your needs accordingly. Look for user-friendly interfaces, intuitive navigation, and helpful customer support. Consider the pricing structure, including any additional fees for state returns or advanced features. It’s also essential to ensure the software is compatible with your operating system or devices. Reading customer reviews and comparing features can help you make an informed decision.

Advantages and Disadvantages of Tax Software 📈📉

Like any other technology, tax software has its pros and cons. Let’s explore some of the advantages and disadvantages:

Advantages:

Time-saving: Tax software automates calculations and eliminates the need for manual data entry, saving time.

Reduced errors: The software performs automatic error-checking, minimizing mistakes and ensuring accurate tax returns.

Convenience: Features like electronic filing and direct deposit options offer convenience and efficiency.

Access to information: Tax software provides up-to-date tax laws and regulations, giving users the information they need.

Maximized deductions: The software prompts users to input relevant information, ensuring they claim all eligible deductions.

Disadvantages:

Cost: High-quality tax software may come at a price, especially for advanced features or business tax preparation.

Learning curve: Some tax software can be complex, requiring users to invest time in learning and understanding the features.

Security concerns: Storing personal and financial information on tax software may raise security and privacy concerns.

Dependency on technology: In the event of technical issues or software crashes, users may face delays or difficulties in filing their taxes.

Limitations for complex cases: Certain complicated tax situations require professional assistance beyond what tax software can provide.

FAQs ❓

Q: Can tax software help me with my business taxes?

A: Yes, many tax software options offer specialized features for small businesses and self-employed individuals.

Q: Is tax software suitable for individuals with multiple sources of income?

A: Absolutely! Tax software can handle various income streams and guide you through reporting them accurately.

Q: Are there free tax software options available?

A: Yes, some tax software providers offer free versions for simple tax returns. However, advanced features may require a paid subscription.

Q: Can tax software help me if I have investments or rental properties?

A: Certainly! Tax software often includes sections dedicated to reporting investments and rental income.

Q: Is electronic filing secure?

A: Yes, reputable tax software providers ensure secure encryption and data protection for electronic filing.

Conclusion 🎯

In conclusion, tax software provides a convenient, efficient, and accurate solution for preparing and filing tax returns. By leveraging the automation and features offered by tax software, individuals and businesses can streamline their tax preparation process and minimize errors. However, it is crucial to consider your specific tax situation, budget, and personal preferences when choosing the right tax software option. Remember to research, compare features, and read reviews to make an informed decision. Take control of your tax obligations with the best tax software for 2023!

Final Remarks 📝

Friends, tax software has revolutionized the way we approach tax preparation and filing. However, it’s important to note that tax software serves as a tool and should not replace the advice of a professional tax advisor or accountant, especially in complex tax situations. Make sure to consult with a tax professional if you have unique circumstances or questions. Happy tax season, and may your tax software journey be hassle-free and rewarding!

This post topic: Software Reviews