Discover The Best Free Tax Software 2022: Unbiased Reviews And Recommendations!

Free Tax Software 2022 Reviews: Finding the Best Option for You

Greetings, Readers! Tax season is upon us, and as we navigate through the complexities of filing our taxes, having the right tax software can make a world of difference. In this article, we will provide you with an in-depth review of the top free tax software options for 2022. With our comprehensive analysis, you’ll be able to make an informed decision and maximize your tax returns. Let’s dive in!

The Importance of Choosing the Right Tax Software

✅ Understanding the features and functionality of tax software can save you time and money

✅ Free tax software can be a cost-effective option for individuals and small businesses

✅ A reliable tax software ensures accurate calculations and reduces the risk of errors

✅ Access to expert support and guidance can simplify the tax filing process

3 Picture Gallery: Discover The Best Free Tax Software 2022: Unbiased Reviews And Recommendations!

What is Free Tax Software?

In today’s digital age, free tax software has become an increasingly popular choice for individuals and businesses alike. Free tax software offers a range of tools and resources to help you prepare and file your taxes without incurring any additional costs. These software solutions are designed to be user-friendly, efficient, and accessible to individuals of all tax-filing backgrounds.

Advantages of Free Tax Software

➕ Cost-effective: As the name suggests, free tax software eliminates the need for spending on pricey tax preparation services

➕ Simplified process: Free tax software guides you through the tax filing process with step-by-step instructions

➕ Accuracy and efficiency: These software solutions perform complex calculations and ensure accurate tax returns

➕ Accessibility: Free tax software can be accessed from anywhere with an internet connection, making it convenient for users

Disadvantages of Free Tax Software

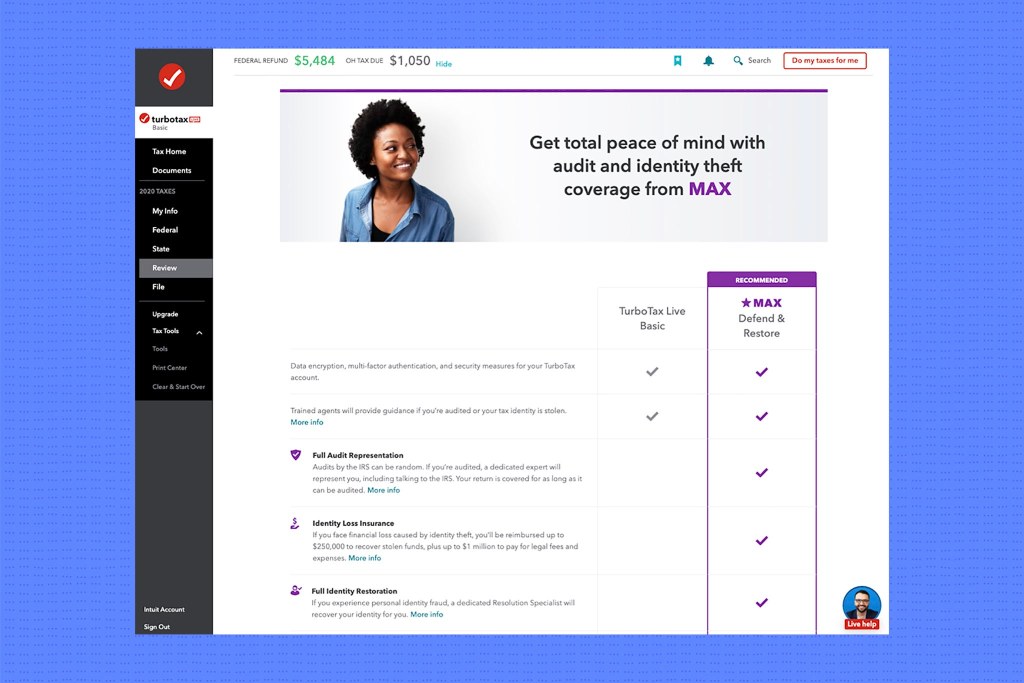

➖ Limited features: Free tax software may lack certain advanced features and support options available in paid versions

➖ Security concerns: It’s important to ensure that the free tax software you choose has robust security measures in place to protect your sensitive information

➖ Learning curve: Some users may find it challenging to navigate through the software initially, especially if they are not familiar with tax filing processes

Who Can Benefit from Free Tax Software?

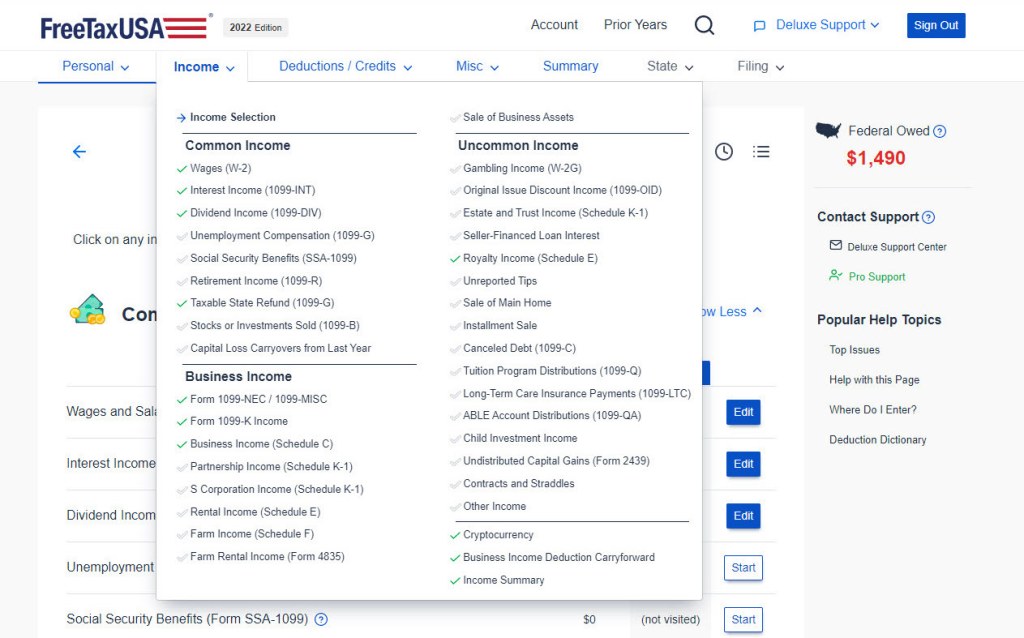

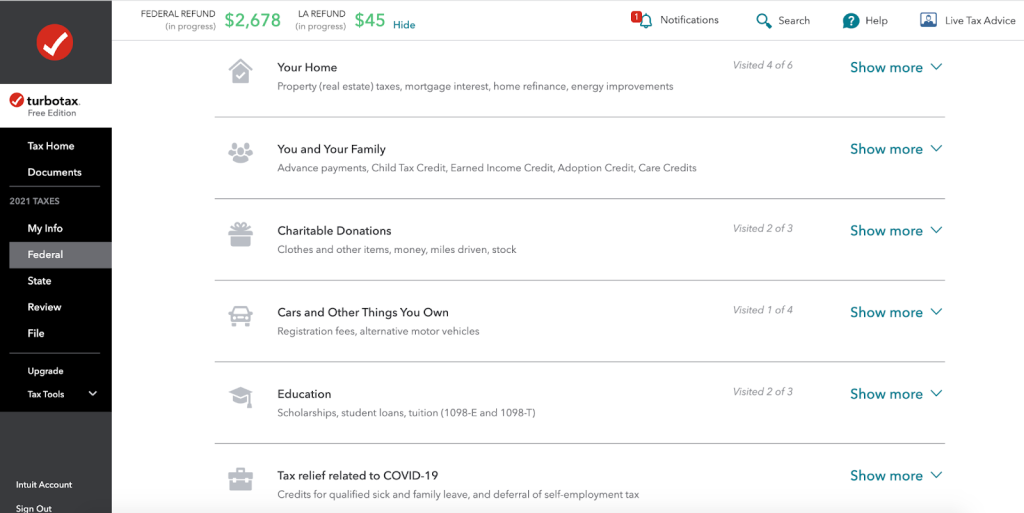

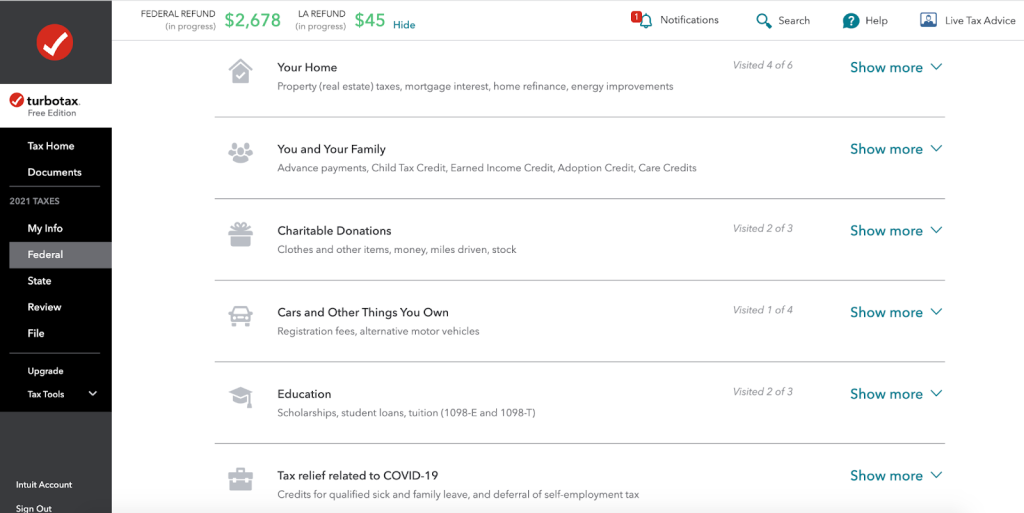

Image Source: pcmag.com

👨💼 Individuals with simple tax situations, such as those with one job and no additional sources of income

👩🔬 Self-employed individuals and freelancers who need to report business income and expenses

🏢 Small business owners with straightforward tax requirements

When Should You Start Using Free Tax Software?

⏰ It’s never too early to start preparing your taxes. Free tax software can assist you throughout the year by keeping track of your income and expenses. However, it’s essential to wait until the tax season officially begins to ensure you have all the necessary documents and information for accurate filing.

Where Can You Find Free Tax Software?

🌐 There are various reputable websites and software providers that offer free tax software for individuals and businesses. Some popular options include TurboTax, H&R Block, and TaxAct. These software solutions are available online, and you can easily access them through their respective websites.

Why Should You Choose Free Tax Software?

🔍 Cost savings: By using free tax software, you can avoid paying expensive fees to tax preparers or purchasing costly software packages

📈 Accuracy: Free tax software is equipped with built-in error checks and calculations, minimizing the risk of mistakes on your tax return

💼 Convenience: With free tax software, you can file your taxes at your own pace and from the comfort of your own home, eliminating the need for in-person appointments

How to Choose the Right Free Tax Software?

🔎 Consider your specific tax needs and ensure that the software you choose offers the necessary features and support

📊 Read reviews and compare different free tax software options to identify the one that best suits your requirements

📞 Check for customer support availability and accessibility, as reliable assistance can be crucial during the tax filing process

Frequently Asked Questions (FAQs)

1. Can I use free tax software if I have complex tax situations?

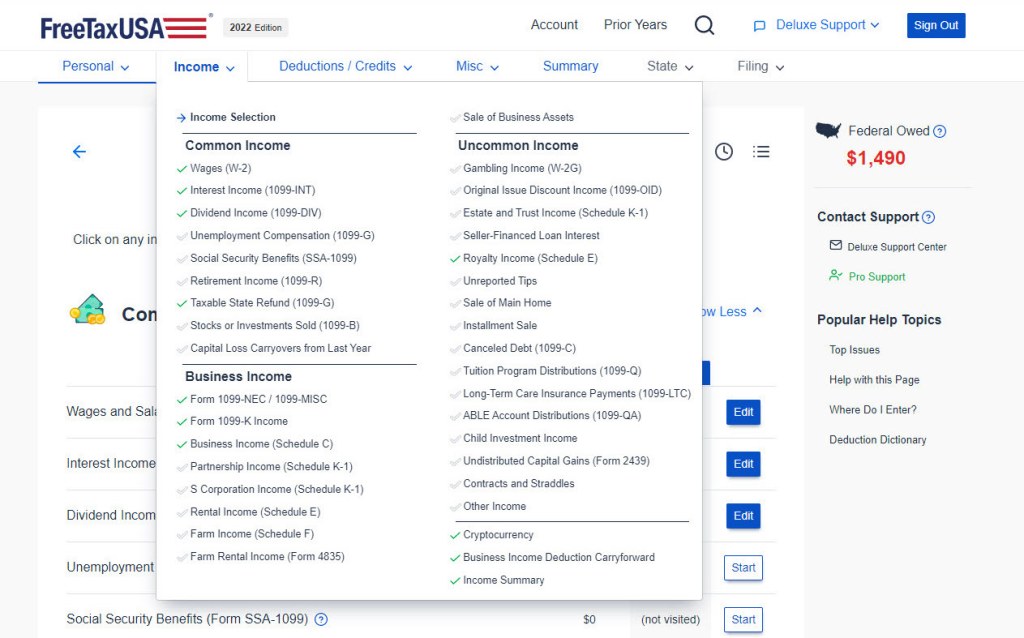

Image Source: thewirecutter.com

Yes, free tax software can handle a variety of tax situations. However, if you have complex tax needs, it may be beneficial to consider paid versions or consult a tax professional for personalized advice.

2. Is free tax software secure?

Most reputable free tax software providers implement robust security measures to protect users’ data. However, it’s essential to choose a trusted software provider and take necessary precautions, such as using secure internet connections and updating your software regularly.

3. Can I file both federal and state taxes using free tax software?

Yes, many free tax software options allow you to file both federal and state taxes. However, it’s important to check the software’s capabilities and ensure that it supports your specific state’s tax requirements.

4. Can I switch from paid tax software to free tax software?

Yes, you can switch from paid tax software to free tax software. However, it’s important to consider any potential differences in features and support before making the switch.

5. Is free tax software suitable for small businesses?

Free tax software can be suitable for small businesses with straightforward tax requirements. However, if your business has complex tax considerations, it may be beneficial to explore paid software options that offer more advanced features and support.

Conclusion: Take Control of Your Taxes with Free Tax Software

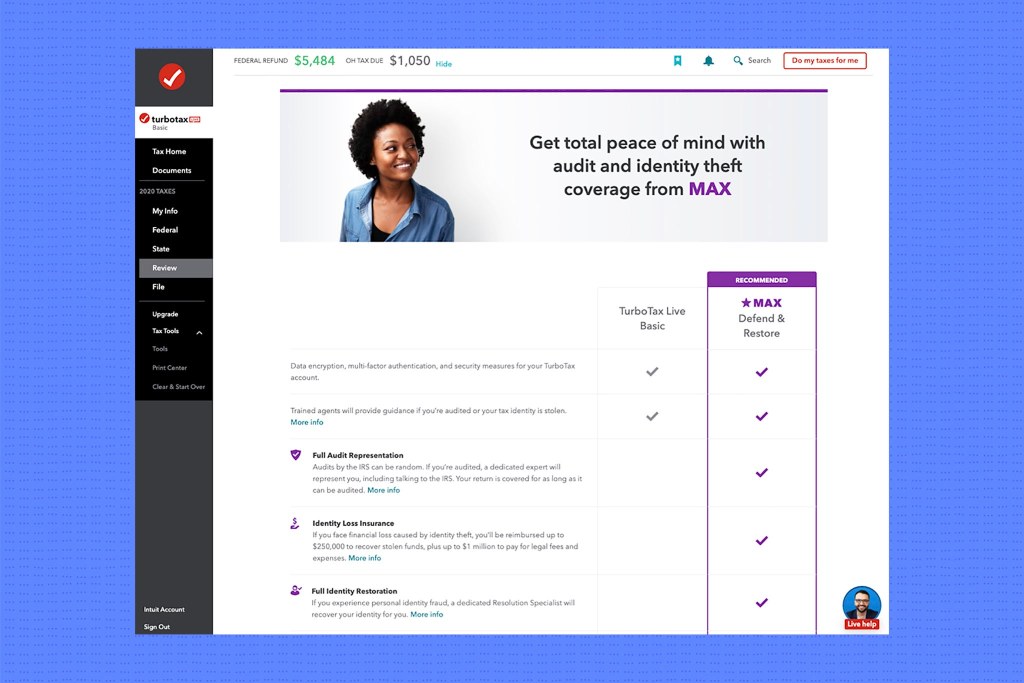

Image Source: forbes.com

In conclusion, free tax software provides an accessible and cost-effective solution for individuals and businesses to file their taxes accurately. By leveraging the benefits of free tax software, you can save time, money, and reduce the risk of errors in your tax returns. Make the most out of the 2022 tax season by choosing the right free tax software that meets your specific needs. Happy filing!

Final Remarks: Making Informed Tax Decisions

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as professional tax advice. It is always recommended to consult with a qualified tax professional or utilize the resources provided by the respective tax software for specific tax-related inquiries and assistance.

Always double-check the accuracy and completeness of your tax returns before submission. Remember to keep copies of all relevant tax documents and maintain organized records for future reference.

We hope this article has provided you with valuable insights into the world of free tax software. By staying informed and leveraging the right tools, you can navigate the tax landscape with confidence. Best of luck with your tax preparations!

This post topic: Software Reviews